Hello friends, Do you also have an account in Bank of India or any Other SBI PNB etc. Government Bank, and every year you receive a message on your mobile saying: “TRF Bima Premium Bank of India (₹436) has been debited from your account.”

₹436 might sound like a small amount, but do you know that behind this lies the safety and security of you and your family? This message is not just a debit alert—it’s a promise that in difficult times, your loved ones will not be alone.

So, why is this ₹436 deducted from your account and what is the truth behind it? Let’s understand it in detail in this post.

My Experience

As you know, in today’s world, life is unpredictable, things can change in a moment.

A while ago, I opened an account in Bank of India, and this year, ₹436 was debited from my account. At first, I was worried about why this amount had been deducted. After asking the bank officials, I came to know that this deduction was for securing my family’s future through an insurance scheme.

| What is TRF? |

|---|

| TRF stands for Transfer—this means the bank has transferred money from your account to the insurance company. In simple terms, it is the process of moving funds from one bank to another. |

What is Bima Premium?

Bima Premium = Insurance Premium (insurance payment).

To keep your insurance active, you have to pay a fixed amount (premium) to the insurance company. Think of it like buying a lock to protect something valuable—in the same way, you pay an insurance premium to secure your life, health, or against accidents.

- If you continue paying the premium, the insurance remains active.

- If you stop paying, the insurance policy will lapse (be discontinued).

Why is ₹436 deducted as TRF Bima Premium in Bank of India?

This deduction happens because you have an active insurance policy linked to your bank account, and the bank automatically deducts the annual premium to keep it active.

For example:

1. Accidental Insurance or Personal Accident Cover

Many banks offer accidental insurance coverage (e.g., ₹2 lakh) with your savings account or debit card. The annual premium is automatically deducted from your account.

2. Life Insurance / Term Insurance

If you have taken life cover via Bank of India, such as under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), the annual premium is ₹436. This amount is usually deducted in May–June every year.

3. Auto-Renewal

If a policy is linked to your account and auto-renewal is enabled, the ₹436 is the yearly premium for PMJJBY, which offers ₹2 lakh coverage.

How I Stopped TRF Bima Premium Deduction from My Bank Account

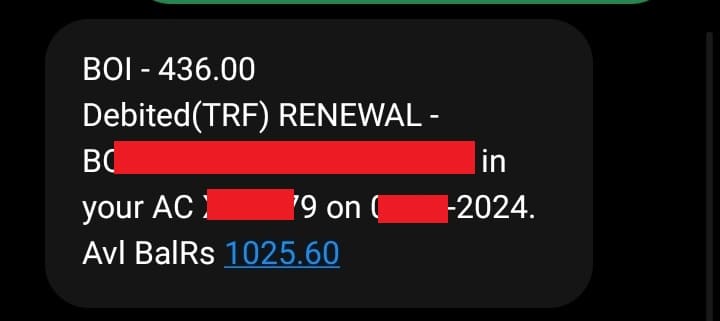

A few months ago, I noticed ₹436 being deducted from my Bank of India account with the description: “TRF Bima Premium Bank of India.”

I had never applied for any such insurance, so I was shocked. When I went through my past statements, I realized it was happening every year around the same time.

Step 1 – Check Your Bank Statement

The first thing I did was log into my Bank of India net banking app and check my account statement. I saw that ₹436 was deducted with the code “TRF” and the description mentioning “Bima Premium.”

Step 2 – Visit the Bank Branch

The next day, I went to my branch and asked the staff about the deduction. The officer told me it was for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), which gives ₹2 lakh life insurance cover. The surprising part? I never signed up for it— they had linked it automatically when I opened my account.

Step 3 – Fill the Cancellation Form

I told them I didn’t want this scheme. They asked me to:

- Write an application requesting cancellation of PMJJBY.

- Fill up the scheme cancellation form they provided at the branch.

- Sign it and attach a photocopy of my passbook and Adhaar/Pan.

Step 4 – Confirmation from the Bank

The bank staff told me the scheme would not renew from the next year. Since it’s an annual deduction (May–June), I had to cancel it before the renewal date.

Step 5 – Final Check

After a month, I checked my account again during the premium deduction period. This time, there was no TRF Bima Premium charge—my cancellation request had worked.

| Quick Steps how to stop trf bima premium charges in boi & Other Bank |

|---|

| 1. Check your account statement – confirm the deduction details. 2. Visit your bank branch – ask about the scheme linked to your account. 3. Fill the cancellation form – provided by the bank. 4. Submit a written application – mention you did not request the scheme. 5. Get confirmation – ensure they note your request before the renewal month. 6. Recheck next year – make sure the deduction has stopped. |

Tip: If you don’t want any unwanted schemes, ask your bank to give you a list of all policies linked to your account and cancel the ones you don’t use.

Also Read : IB ACIO Full Form and Meaning

FAQs – TRF Bima Premium Bank of India (₹436)

This is the annual premium for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), which offers ₹2 lakh life cover.

Yes. Visit your branch, fill the cancellation form, and submit a written request to stop the linked insurance.

No. It is optional, and you can cancel it anytime if you do not want the coverage.

It is usually deducted once a year, between May and June, depending on your policy start date.

Check your bank statement or you can also ask your branch for a list of all insurance policies linked to your account.

Your insurance policy will lapse, and you will lose the coverage benefits.