Have you also received a message from your bank about an insurance premium deduction? Maybe you noticed ₹436, ₹228, or even ₹20 being deducted from your account and wondered “Why is this money being cut?” If some service-related charge is being deducted, the question naturally comes to mind: “I never started any such service, so how is it being deducted automatically?”

When we visit the bank in such situations, we learn that this is related to PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana). Under this scheme, ₹436 or other amounts are deducted from your account. This insurance provides ₹2 lakh to the family if the policyholder unfortunately passes away due to any reason.

This sounds good so far, but the question remains: How did this start when we never applied for it? And in such circumstances, how can we stop it?

If you have money in your account, this scheme might be good for you. But imagine you’ve saved ₹800 or ₹1000 in your account for something specific, and suddenly ₹436 gets deducted – this can cause real problems for you.

Also Read : What Is TRF Bima Premium?

What is PMJJBY Bima Premium Deduction?

PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) is a government-backed life insurance scheme launched in 2015. Under this scheme, your bank automatically deducts the insurance premium from your savings account.

| Feature | Details |

| PMJJBY Full Form | Pradhan Mantri Jeevan Jyoti Bima Yojana |

| Insurance Coverage | ₹2 lakh on death due to any reason |

| Annual Premium | ₹436 per year |

| Age Eligibility | 18 to 50 years (coverage continues till age 55) |

| Policy Period | 1st June to 31st May every year |

| Premium Payment | Auto-debit from savings account |

Why Different Amounts Are Deducted?

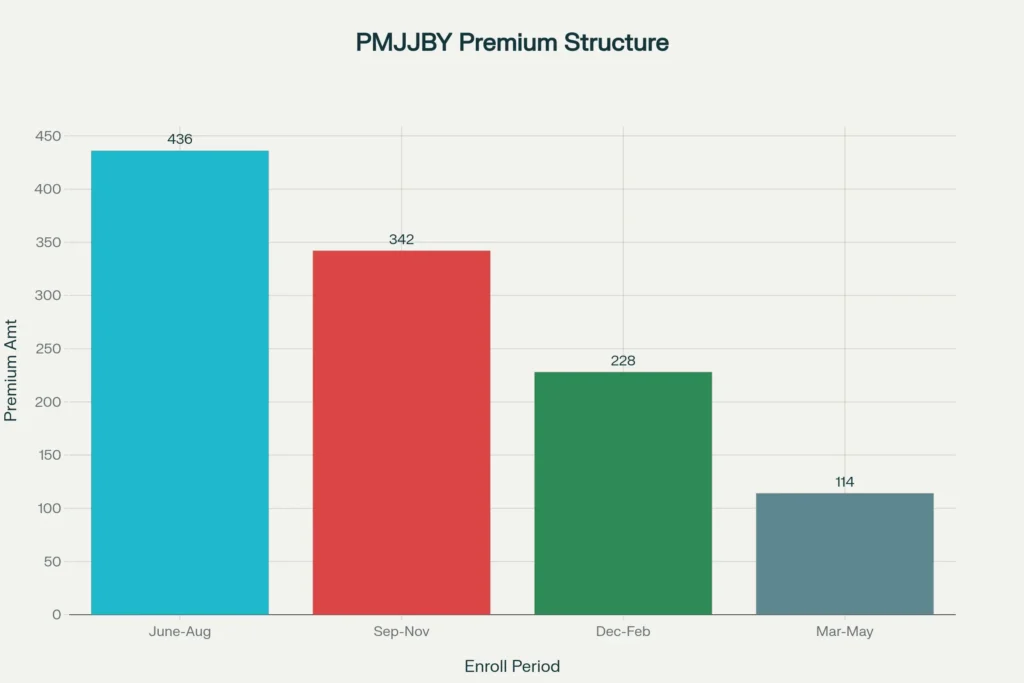

The premium amount depends on when you enroll during the policy year:

| Enrollment Period | Premium Amount (₹) | Coverage Duration | Reason |

| June to August | 436 | Full Year | Complete annual premium |

| September to November | 342 | 9 months | Pro-rata for 3 quarters |

| December to February | 228 | 6 months | Pro-rata for 2 quarters |

| March to May | 114 | 3 months | Pro-rata for 1 quarter |

How Did This Insurance Start Without Your Approval?

Many banks automatically enroll their customers in PMJJBY without explicit consent to increase insurance coverage under government social security programs. This often happens when:

- Opening New Accounts: Banks may include PMJJBY enrollment in account opening forms

- Government Initiatives: To meet targets for financial inclusion schemes

- Default Enrollment: Some banks treat it as an opt-out rather than opt-in service

- Unclear Consent: Forms may have pre-checked boxes that customers don’t notice

Benefits of PMJJBY TRF Bima Premium

Despite the automatic enrollment concerns, PMJJBY offers several advantages:

Financial Benefits

- Affordable Coverage: Only ₹436 per year for ₹2 lakh coverage

- No Medical Exam: Simple enrollment without health checkup

- Death from Any Cause: Coverage includes natural death, accidents, and even during pandemics

- Government Backing: Supported by LIC and other authorized insurers

Convenience Features

- Automatic Renewal: Policy renews every year automatically

- Easy Claims: Simple claim process for nominees

- Wide Network: Available through all participating banks

- Tax Benefits: Death benefit is tax-free for nominees

Also Read : How to Stop TRF Charges BOI

Potential Drawbacks and Concerns of Bima Premium

While PMJJBY has benefits, there are some genuine concerns:

Common Problems

- Unintentional Enrollment: Many people get enrolled without clear understanding

- Unexpected Deductions: Sudden premium deduction can cause financial inconvenience

- Limited Coverage: ₹2 lakh may not be sufficient for all families

- 30-Day Wait Period: No coverage for natural death in first 30 days after enrollment

Financial Impact

Imagine you’ve carefully saved ₹800-1000 for an emergency or specific purpose, and suddenly ₹436 gets deducted. This can create real problems, especially for:

- Daily wage workers

- Students with limited funds

- People managing tight budgets

- Those unaware of the deduction schedule

How to Stop ₹436 PMJJBY Premium Deductions

If you want to discontinue PMJJBY and stop future deductions, here are the methods:

Method 1: Through Net Banking

- Login to your bank’s internet banking

- Navigate to Insurance or Services section

- Select PMJJBY from insurance options

- Choose “Deactivate” or “Cancel Subscription”

- Confirm your decision and save changes

Method 2: Visit Bank Branch

- Visit your home branch with ID proof

- Request PMJJBY deactivation form

- Fill the form completely with account details

- Submit to bank officer for processing

- Get acknowledgment receipt

Method 3: SMS Method

- Send “PMJJBY STOP” to your bank’s designated SMS number

- Reply “YES” to confirmation message

- Wait for acknowledgment from bank

Method 4: Customer Care

- Call your bank’s customer care number

- Provide account details for verification

- Request PMJJBY deactivation

- Note the complaint/request number for follow-up

Important Things to Remember

Before Stopping PMJJBY Bima Premium

- Consider Your Needs: Do you have other life insurance coverage?

- Family Situation: Will your family need financial support if something happens?

- Cost vs Benefit: ₹436 per year is quite affordable for ₹2 lakh coverage

- Age Factor: It becomes harder to get life insurance as you get older

After Stopping

- Confirmation: Ensure you receive written confirmation of deactivation

- Monitor Account: Check that no further deductions happen

- Alternative Coverage: Consider other life insurance options if needed

- Re-enrollment: You can rejoin PMJJBY in future if circumstances change

FAQs

No error. You likely enrolled mid-year. PMJJBY charges pro-rata based on remaining coverage months.

Unfortunately, no refunds are available once the premium is deducted and policy is active for that year.

PMJJBY premium is reviewed periodically. It was ₹330 initially, increased to ₹436 in recent years.

Your PMJJBY coverage will lapse automatically. You’ll need to re-enroll if you want to continue.

Absolutely! Your nominees should know about the policy and keep necessary documents ready for claims.