Hello friends! Have you also received a message on your mobile phone saying “TRF ATM CARD MAINT CHARGE” from Bank of India (BOI)? If yes, you’ve probably seen charges like Rs. 295 being deducted from your account with a message like “295.00 Rs (TRF) ATM CARD MAINT CHARGE”. Many customers get confused about why this charge appears in their account.

In the past, when banking wasn’t digital, customers mostly relied on passbooks and counter transactions for their banking needs. Banks used to charge various fees like:

- ATM charges

- Chequebook charges

- Demand draft charges

- Duplicate passbook charges

These charges were needed to cover the bank’s operational expenses. I remember once my father’s account was debited Rs. 150, and when I asked the bank officer, I learned that banks charge these fees to keep accounts active and maintained.

Today, most transactions happen through ATMs, debit cards, and UPI. Now banks charge ATM card maintenance fees to run these services. Previously, banks spent money maintaining passbooks and chequebooks, but now the same cost has shifted to maintaining cards and digital services.

What is TRF ATM Card Maint Charge

This charge is actually the annual maintenance fee for your debit/ATM card. This money is deducted to keep your card always active and secure, so you can withdraw cash from ATMs, make online payments, UPI transactions, and enjoy other banking services without any problems.

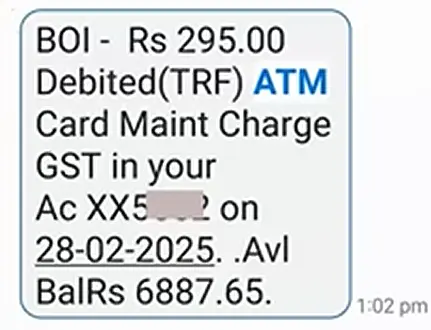

When you receive a message like “Rs. 295.00 debited (TRF) ATM Card Maint Charge GST”, it means:

- TRF = Transfer (money transferred from your account)

- ATM Card Maint = ATM Card Maintenance

- Charge GST = Including 18% Goods and Services Tax

This is an annual charge that will be deducted every year to keep your card active and functional.

| Short Form | Full Form |

|---|---|

| TRF | Transfer |

| Maint | Maintenance |

| BOI | Bank Of India |

| GST | Goods and Services Tax |

Also Read :

- How To Stop TRF Charges In BOI

- Aeps Full Form in Banking

- How to Cancel TRF Bima Premium

- Nach Full form in Banking

What Services Are Covered Under MAINT CHARGE?

The maintenance charge covers several banking services like:

| Service Category | Description | Included in Maintenance |

| Card Annual Fee | Yearly fee to keep card active and functional | Yes |

| SMS Alert Service | Transaction notifications sent to registered mobile | Separate charges apply |

| Network Charges | Charges to card networks like RuPay/Visa/MasterCard | Yes |

| Insurance Cover | Accidental insurance coverage (varies by card type) | Yes (select cards) |

| Customer Support | 24/7 customer service and support | Yes |

| Card Replacement Security | Security features and fraud protection | Yes |

| Digital Banking Access | Access to internet and mobile banking | Yes |

| Transaction Processing | Processing of ATM and POS transactions | Yes |

BOI ATM Card Annual Maintenance Charges (2025)

Based on official Bank of India documents, here are the current maintenance charges:

| Card Type | Base Charge (Rs.) | GST @18% (Rs.) | Total Charge (Rs.) |

| Classic Debit Card | 250 | 45 | 295 |

| Platinum Debit Card | 300 | 54 | 354 |

| RuPay Select | 800 | 144 | 944 |

| Visa Bingo | 200 | 36 | 236 |

| Prepaid (Re-loadable) | 100 | 18 | 118 |

| Travel Card | Min. 150 | Min. 27 | Min. 177 |

| Gift Card (Non Re-loadable) | 50 | 9 | 59 |

| Visa Signature | 800 | 144 | 944 |

| Master World | 800 | 144 | 944 |

| Digital Debit Card | 0 | 0 | 0 |

| KMUT Card | 0 | 0 | 0 |

Important Note: GST at 18% is added to all base charges as per current tax regulations.

Why Do Banks Charge Maintenance Fees?

Banks implement maintenance charges for several important reasons:

- Operational Costs: Maintaining ATM networks, card processing systems, and digital infrastructure

- Security Systems: Advanced fraud protection and security features

- Customer Support: 24/7 helpline and customer service

- Technology Updates: Regular system upgrades and maintenance

- Insurance Coverage: Accident insurance provided with certain cards

- Network Fees: Payments to card networks like RuPay, Visa, MasterCard

Benefits You Get for Paying Maintenance Charges

Benefits You Get for Paying Maintenance Charges

Security Benefits

- Immediate fraud detection through SMS alerts

- Account monitoring for all transactions

- Insurance coverage (varies by card type)

- Advanced security features like chip and PIN

Convenience Features

- 24/7 ATM access across India

- Online shopping capability

- UPI transactions support

- Digital wallet integration

- International usage (select cards)

Accounts That Don’t Have to Pay MAINT CHARGE

Several account types are completely exempted from ATM card maintenance charges:

| Account Type | Scheme Codes |

| PMJDY (Jan Dhan) Accounts | SB181/SB182/SB183/SB104/SB105/SB106/SB190/SB107 |

| BSBD (Basic Savings) Accounts | BSBD Schemes |

| Jai Jawan Salary Plus – Commissioned Officers | SB161 |

| Jai Jawan Salary Plus – Non-Commissioned Officers | SB162 |

| Para Military Forces Employees | SB163 with Code 0201 |

| Central/State Govt. University Employees | SB163 with Code 0202 |

| Public Sector Undertaking Employees | SB163 with Code 0203 |

| Staff & Ex-Staff Accounts | Staff Accounts |

Special Note: If your account is maintained with zero balance under specific schemes, these maintenance charges don’t apply.

What Happens if You Don’t Pay Maintenance Charges?

If maintenance charges aren’t paid then:

- Service Disruption: Your debit card services may be blocked

- Transaction Restrictions: ATM withdrawals and online payments may stop

- Reminder Messages: Bank will send payment reminders

- Reactivation Fees: Additional charges may apply to reactivate services

How To Manage/Stop TRF ATM Card Maint Charge

- Choose the Right Card: Select a card type that matches your usage

- Check Exemption Eligibility: Verify if you qualify for free maintenance

- Maintain Required Balance: Some accounts waive charges with minimum balance

- Use Digital Payments: Reduce dependency on physical cash withdrawals

- Monitor Charges: Regularly check your bank statements

TRF ATM Card Maint Charge (FAQs)

Yes, it’s an official Bank of India annual maintenance charge for debit cards.

Yes, if you have exempted account types like PMJDY, BSBD, or salary accounts.

Once annually, usually on the card’s anniversary date.

The charge applies regardless of usage frequency – it’s for keeping the card active.