Nach Full Form, meaning, Debit & Credit: Do you also think this is a very unheard word for those who are away from the banking line and go to the bank only occasionally, but some people know what NACH is? This post is important for all those people who do not know about NACH and want to know.

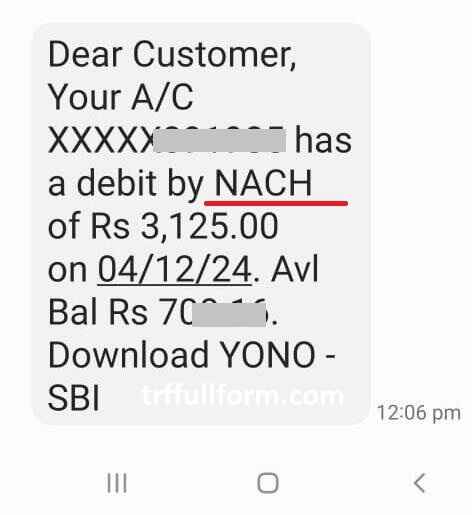

As you know how easy it has become to transfer money in today’s time. Even if you ask a child, he sends the money in a minute. Through digital services, we can do every work in a few moments, for which earlier one had to wait for days. Have you ever wondered how your salary comes into your account, the salary of all those working with you is credited at one time. And when you pay a loan, how does it get automatically deducted from your account? Have you ever thought how this happens?

Sometimes your account gets debited and sometimes the amount gets credited. How does all this happen? All these questions that are running in your mind will be answered today through this post.

Today, through this post, we will know what is the full form of NACH? What is NACH in Banking? What are its benefits? We will also know more & Other important information Related to Nach.

| Nach Full Form |

|---|

| What is the full form of NACH? |

| NACH :- National Automated Clearing House |

What is NACH in Banking

The word Nach, as you know, is now important for money and time in the digital world. It is an electronic payment system which is run by the National Payments Corporation of India (NPCI) in India. Its purpose is to make banking and money transactions simple, secure, and fast. NACH is mainly used for large-scale payments like salary payments, bill payments, loan installments, and dividends on debentures or company shares are also received through NACH.

NACH stands for National Automated Clearing House. It is a system in India that makes transferring money fast and easy. Banks, companies, and the government use it to send or take money automatically from your account.

With NACH, you don’t need to worry about paying bills, EMIs, or getting your salary—it happens on time without any manual effort. It’s safe, reliable, and works for things like subsidies, refunds, and regular payments.

Let us understand with an example:-

Suppose, Vivan’s parents put money in Vivan’s account every month. Earlier, if Vivaan’s parents had to go to the bank every month with cash, it would take a long distance and a waste of time. But now, with the use of NACH, his parents can just tell the bank once, “add money to Vivaan’s account every month” and the bank will do it automatically every month without any help from anyone.

So, with the help of NACH, money automatically gets transferred to Vivaan’s account every month, without anyone knowing or manually adding money. It’s so easy and quick!

It is also used for things like salary, bills, or loan installments.

Also Read: TRF Full Form : What is TRF Meaning, Renewal, Charges, lien lift & Debited TRF in Banking

Types of NACH

NACH payments are of 2 types. By the word payment, you have understood that it is the payment that you make and the payment that you receive.

NACH Credit: – In this, money is credited by the bank to the account of a person or organization. It can be the salary of workers or any other type of government assistance payment. You must have seen that you get a large payment on the share, that too safely, it is a reliable process.

Why is Nach Credit in my account : Common Reasons

- Salary: Money from your job

- Government Help: Like a subsidy or pension

- Refunds: Getting back extra money you paid

- Loan Amount: Bank giving you loan money

- Interest or Rewards: Extra money from bank savings or shares.

NACH Debit:- It automatically debits the amount from the bank account. For example, if you are subscribing to a service, let’s say your Netflix subscription, then it is a payment that you make. You have subscribed and then paid once and then Netflix takes permission from you whether further payment will be automated or not, if you say yes, then the money is automatically deducted every month through NACH.

Why is Nach Debit in my account : Common Reasons

- EMIs: Monthly payments for loans

- Bills: Paying electricity, water, or phone bills

- Insurance: Regular payments for your policy

- Subscriptions: For apps, services, or memberships

- Mistake Refunds: Taking back extra money sent to you.

What are the benefits of NACH?

As you must have read about it above, the most important benefit is that it is safe and provides complete trust of time.

Automated Payment: This system processes payments automatically, it requires permission only once.

Speed of clearing and settlement: Transactions are cleared quickly and safely with NACH.

Large scale payments: NACH can process large scale payments (such as paying salaries to thousands of employees).

Low cost: This payment system usually operates at a lower cost than other payment methods.

Time saving: Through NACH, payment can be made to anyone in a few moments.

NACH Full Form & Details FAQs:

Nach full form is National Automated Clearing House

You might receive a NACH credit for payments like government subsidies, salary, dividends, or refunds.