TRF Limited, the famous Tata company from Jamshedpur, is a true name in India’s material handling and EPC (Engineering, Procurement & Construction) segment. When anyone from Jharkhand, Odisha, or the steel belt checks the stock market app in the morning, TRF’s name pops up—and for good reason. Whether you’re an old-school investor or a new-age trader, TRF Ltd’s journey from desi industrial solutions to aggressive stock price targets has become a topic at chai stalls and WhatsApp groups.

The Tata Connection: Trust & Tradition

A huge part of the TRF story is its Tata DNA. Ask any Indian—Tata means trust, stability, and ethical business. TRF Ltd falls under the Tata Steel umbrella, making it a tried and tested bet for long-term investors

So, for those thinking, “Is TRF a Tata Company?”—the answer is YES, pakka!

How’s TRF Ltd Doing Today?

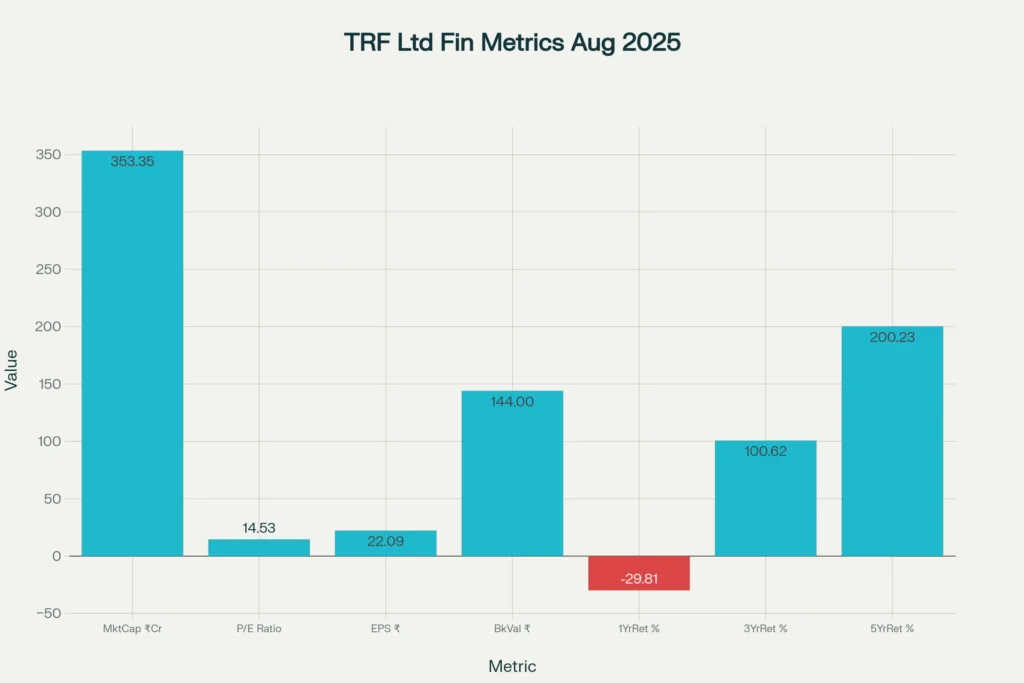

Here’s the current picture:

| Metric | Value (Aug 2025) |

| Price | ₹321.10 |

| Market Cap | ₹353.35 Crore |

| P/E Ratio | 14.53 |

| EPS | ₹22.09 |

| Book Value | ₹144.00 |

| 1-Year Return | -29.81% |

| 3-Year Return | 100.62% |

| 5-Year Return | 200.23% |

Note: TRF’s price has gone up and down, but long-term growth remains hot. Even after a rough one-year patch, the long-term numbers look strong and promising for patient investors.

TRF Limited Share Price Target Analysis (2025–2030)

Technical Chart: Where’s the Stock Headed Next?

The graph below shows why investors are so excited about TRF. From ₹455 in 2025 to a projected ₹5,374 in 2030, it’s all about the upward journey!

Clearly, the market expects TRF to benefit from Tata Steel’s big projects, government infra push, and sector growth. Each line on the chart shows the forecast for Initial, Mid-Year, and Year-End targets—handy for both daily traders and long-time holders.

Sector & Fundamentals: Why TRF Has Staying Power

- Tata Promoter Strength: Any Tata stock brings instant credibility. Whether in Mumbai or Darjeeling, investors love Tata’s name.

- Industrial Growth: TRF rides on India’s push for new ports, mining, and steel operations—sectors that the Modi government keeps prioritizing.

- EPC & Bulk Handling: TRF’s big clients include cement, mining, and power companies. Their heavy machinery is the backbone for these core sectors.

What Drives the Targets?

Re-rating potential: As TRF improves profits and reduces debt, analysts give higher targets, often based on technical models and Tata goodwill.

Macroeconomic tailwinds: Infrastructure budgets, steel demand, and mining expansions boost TRF’s order book and stock sentiment.

Stock Market Volatility: Should You Be Cautious?

Like all Indian mid-cap stocks, TRF is volatile. There are sharp swings—great for swing traders, but risky for short-term speculators. For long-term Desi investors (“buy and forget” types), the Tata legacy and EPC sector give confidence.

TRF Share Price Targets 2026–2030

| Year | Initial Target | Mid-Year Target | Year-End Target |

| 2025 | ₹455.87 | ₹543.69 | ₹668.49 |

| 2026 | ₹691.65 | ₹824.90 | ₹1,014.25 |

| 2027 | ₹1,049.39 | ₹1,251.56 | ₹1,538.85 |

| 2028 | ₹1,592.16 | ₹1,898.90 | ₹2,334.78 |

| 2029 | ₹2,415.67 | ₹2,881.06 | ₹3,542.40 |

| 2030 | ₹3,665.12 | ₹4,371.22 | ₹5,374.62 |

Note: Forecasts show strong rise, but remember, targets are based on technical analysis & can change based on new results. Always invest carefully!

TRF Limited Share Price Targets 2025

- Forecast (Bullish Scenario): TRF is likely to stage a recovery following volatility in 2024–2025, with targets of ₹455.87 (Jan) up to ₹668.49 (Dec).

- Drivers: Return of capex cycle, order inflows, and improved earnings.

- Risk Factors: Slowdown in infra spending, high costs, execution risk.

TRF Limited Share Price Targets 2026

- Forecast: ₹691.65 to ₹1,014.25, continuation of growth as operational metrics stabilize.

- Catalysts: Sector consolidation, company re-rating, Tata group synergies.

TRF Limited Share Price Targets 2027

- Forecast: ₹1,049.39 to ₹1,538.85; expected acceleration from completed projects and increased demand.

- Risks: Global trade disruption, regulatory changes.

TRF Limited Share Price Targets 2028-30

- Bullish Projection: By 2030, targets forecast up to ₹5,374.62, assuming compounding growth, sector tailwinds, and strong market sentiment.

- Long Term: If TRF can deliver on contracts, expand margins, and maintain efficient capital structure, the stock could emerge as a major mid-cap multi-bagger.

Is TRF Limited Stock a Good Indian Investment?

My Final Thoughts: TRF Limited, being a Tata company, carries years of legacy, trust, and power in India’s industrial landscape. If you want a piece of Indian growth and are willing to hold for several years, TRF could be a solid pick. History shows Tata stocks have rewarded patience. However, don’t forget—market risk is real, stock prices don’t move in a straight line.

Whether you’re a seasoned investor, a young trader in Delhi, or a retiree in Ranchi, keep your research strong and track both sector news and TRF’s quarterly performance. That’s the best way forward for smart investing!

FAQs :

If sector and company growth continue, it’s possible, but always keep an eye on market risks.

TRF is great for long-term, patient investors who believe in India’s infra story and Tata’s legacy.