Hello friends! Do you have an account with SBI Bank or any other bank? Have you ever noticed that whenever you withdraw or deposit money, you get an SMS with terms like “DR to TRFR” or “CR to TRFR”? Does this message scare you and make you rush to the bank to understand what’s happening? This wastes so much of your time, right?

Many people who don’t know about these banking terms like Cr by trfr Meaning (what we learned in the last post), DR to trfr, By TRFR, To TRFR, CR To TRFR etc. get really confused. But by the end of this post, you’ll have complete knowledge about what these codes mean!

Today we’ll learn what DR to TRFR means, what CR TRFR means, and get all the important details about banking transaction codes.

What Does DR To TRFR Mean?

DR To TRFR stands for “Debit to Transfer”. In simple terms:

- DR (Debit) = Money Being Cut/Deducted from your account.

Example: If you have ₹5,000 in your account and you transfer ₹1,000 to someone, your account balance becomes ₹4,000. This ₹1,000 deduction is called DR.

CR To TRFR Mean?

CR To TRFR stands for “Credit to Transfer”. In simple terms:

- CR (Credit) = Money Coming In/Being Added to your account.

Example: Suppose I have ₹5,000 in my account and someone sends me ₹2,000. Now my balance becomes ₹7,000. This ₹2,000 addition is called CR.

Also Read : TRF Full Form in Hindi

Common Transaction Codes in SBI Statements

| Short Form | Full Name | When It’s Used | Example |

| DR | Debit (Money Cut) | When money goes out of your account | You transferred ₹1,000 to someone |

| CR | Credit (Money Added) | When money comes into your account | ₹5,000 deposited in your account |

| To TRFR | To Transfer (Money Sent) | When you send money from your account | You sent ₹2,000 to someone else |

| By TRFR | By Transfer (Money Received) | When someone sends money to your account | Someone put ₹3,000 in your account |

| ATM WDL | ATM Withdrawal | When you withdraw cash from ATM | You withdrew ₹500 from ATM |

| INT CR | Interest Credit | When bank adds interest | Bank added ₹250 interest to your account |

| CHQ DEP | Cheque Deposit | When you deposit a cheque | ₹10,000 deposited via cheque |

Important Message for SBI Customers📝

Always monitor your bank statements regularly. Even though DR To TRFR entries are usually legitimate transactions you’ve made, it’s good practice to verify each entry to ensure your account security.

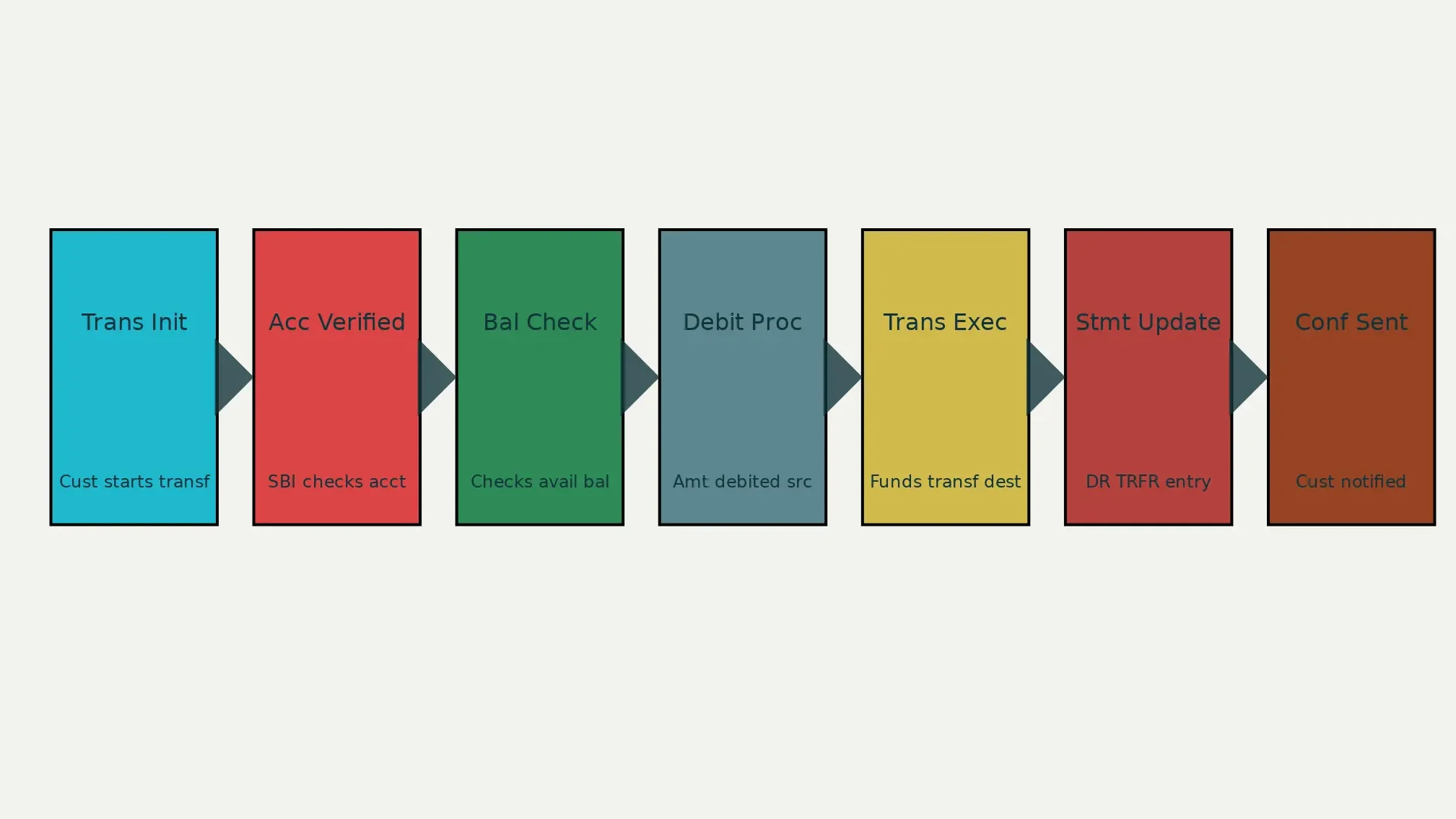

Step-by-Step Transaction Process

Here’s how a DR To TRFR transaction works in SBI:

- Transaction Initiated : You start a transfer or payment

- Account Verification : SBI checks your account details

- Balance Check : System ensures you have enough money

- Debit Processing : Amount is deducted from your account

- Transfer Execution : Money is sent to the destination

- Statement Update : DR To TRFR entry is recorded

- Confirmation Sent : You receive SMS or app notification

DR TO TRFRF FAQs

Yes, DR always means debit – money going out of your account.

Only if it was unauthorized or erroneous. Contact SBI customer care immediately.

Sometimes the bank’s system uses generic codes, but you can get detailed information from customer service.

Most are instant, but some may take 1-2 working days depending on the type.