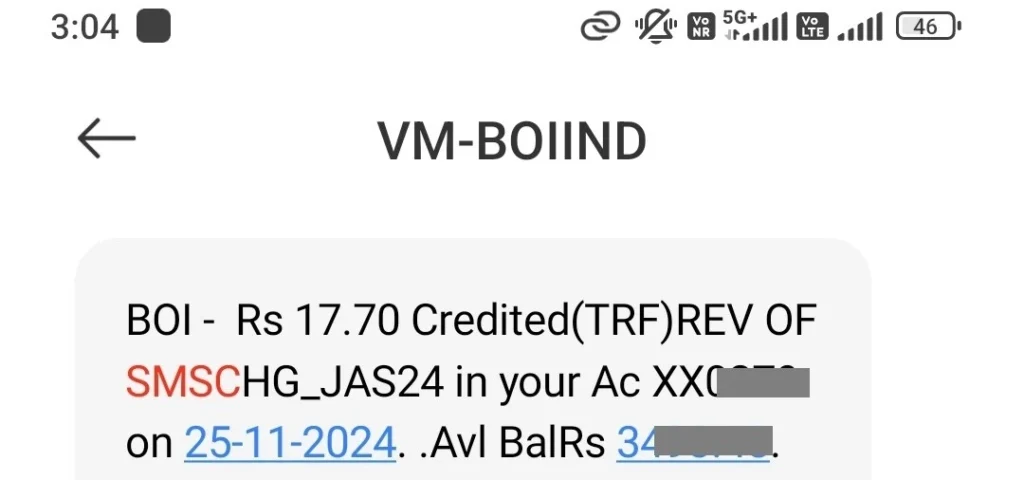

Have you received a “BOI TRF SMS Charges or BOI 17.70 Debited(TRF) SMSChrgs ” message on your mobile phone or seen this charge in your bank statement and wondered what it’s for? Many Bank of India customers get confused about why this charge appears in their account. This charge is related to SMS alert services that the bank provides to keep you informed about every transaction in your account.

In simple terms, BOI TRF SMS charges are fees that Bank of India collects for sending you text messages about money transfers and other account activities. Every time money moves in or out of your account, the bank sends you an instant SMS notification, and there’s a small cost associated with this service.

What is BOI TRF SMS Charges?

TRF stands for “Transfer” in banking terminology. When you see “BOI TRF SMS Charges” in your account, it means you’re being charged for SMS notifications related to fund transfers and other account activities.

Why These Charges Apply

- SMS Alert Service: Every time you transfer money (TRF entry), the bank sends an instant message to your registered mobile number

- Security Reasons: Immediate notification helps you detect any unauthorized activities quickly

- Service Cost: Banks charge for this SMS service as part of their digital banking offerings

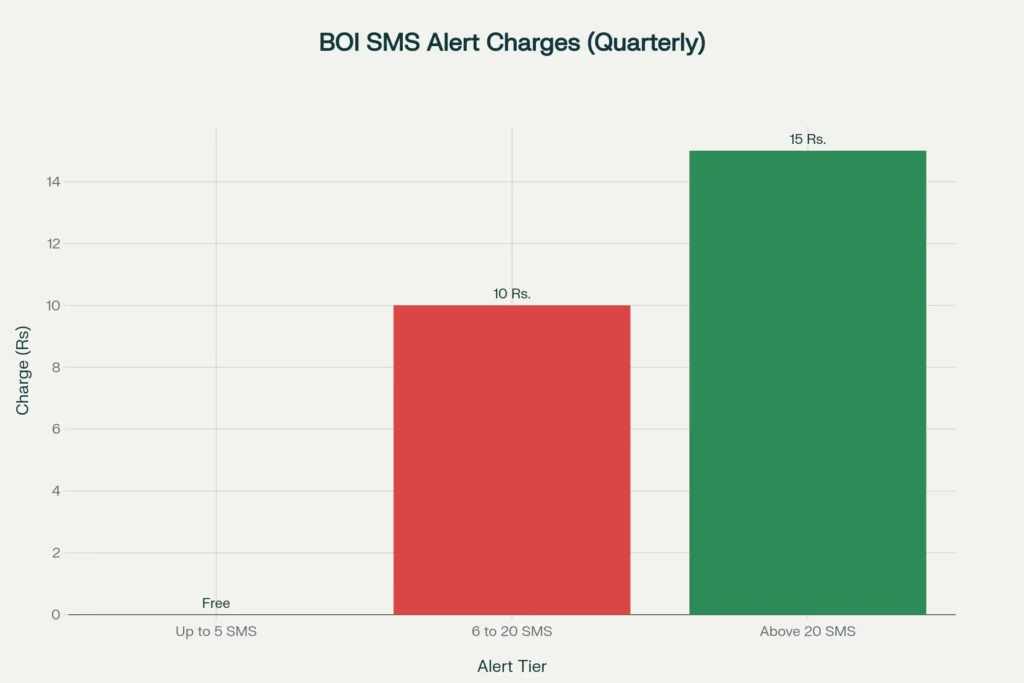

Current BOI SMS Alert Charges (2026)

Based on official Bank of India documents, here are the current SMS alert charges:

| SMS Alert Category | Quarterly Charges (Excluding GST) | Details |

| Up to 5 SMS Alerts | Free | First 5 SMS alerts per quarter are completely free |

| From 6 to 20 SMS Alerts | Rs. 10/- | For 6-20 SMS alerts, Rs. 10 charged per quarter |

| Above 20 SMS Alerts | Rs. 15/- | For more than 20 SMS alerts, Rs. 15 charged per quarter |

Who is Exempted from SMS Charges?

- The following account holders don’t have to pay SMS alert charges:

- Staff & Ex-Staff accounts

- Accounts opened under Prime Minister Jan Dhan Yojana (PMJDY)

- BSBD (Basic Savings Bank Deposit) Schemes accounts

- Pensioners accounts

- Senior Citizens accounts

- Salary accounts (SB-161-165 and SB-101 with Special Charge Code “NOMIN”)

Types of Transactions That Trigger TRF SMS

- TRF specifically refers to “Funds Transfer” activities including:

- NEFT (National Electronic Funds Transfer)

- IMPS (Immediate Payment Service)

- UPI (Unified Payments Interface)

- Internal bank transfers

- RTGS (Real Time Gross Settlement)

- Each transaction generates an SMS alert, which is why you see TRF-related charges in your account.

How to Manage TRF SMS Charges

Understanding Your Usage

- Monitor how many SMS alerts you receive each quarter

- First 5 alerts are always free

- Plan your transactions if you want to stay within the free limit

Cost-Effective Tips

- Use internet banking or mobile banking for transfers when possible, as these often have lower or no charges

- Consolidate multiple small transfers into one larger transfer

- Consider the total cost when making frequent transfers

Why Banks Charge for SMS Alerts

Banks implement SMS charges for several reasons:

- Operational Costs: Sending SMS messages involves costs from telecom providers

- Service Maintenance: Maintaining 24/7 alert systems requires infrastructure

- Regulatory Compliance: Following RBI guidelines on actual usage-based charging

- Resource Management: Encouraging efficient use of the service

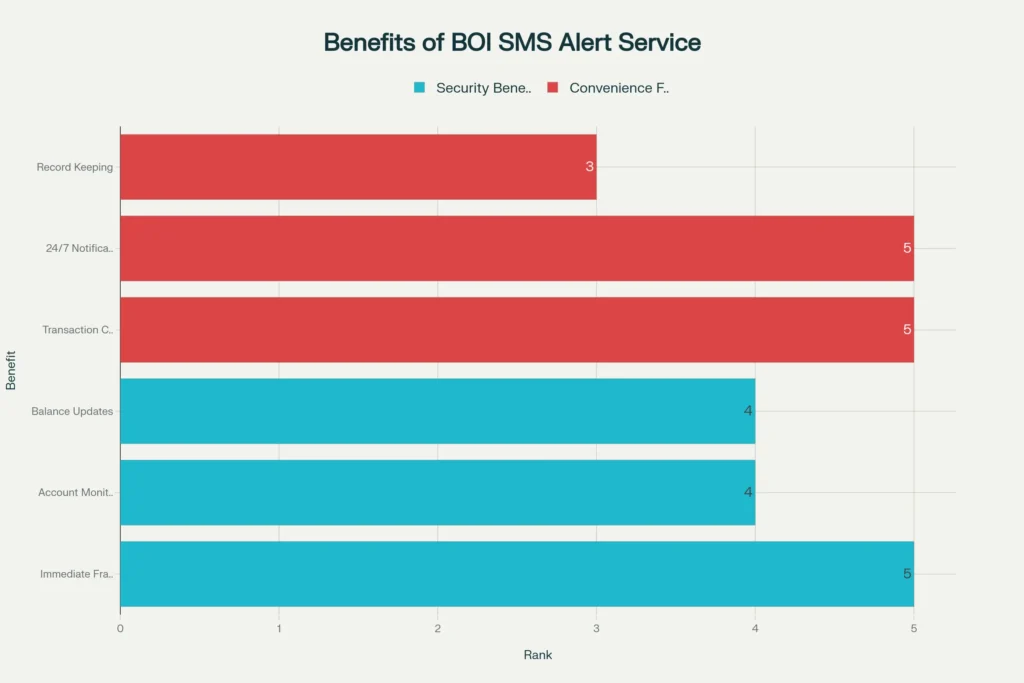

Benefits of SMS Alerts Despite the Charges

The SMS alert service from Bank of India provides valuable benefits that justify the small quarterly charges. Here’s a visual breakdown of these benefits:

Security Benefits

- Immediate Fraud Detection: Know instantly if unauthorized transactions occur

- Account Monitoring: Keep track of all account activities

- Balance Updates: Regular updates on your account balance

Convenience Features

- Transaction Confirmation: Instant confirmation of successful transfers

- Record Keeping: SMS messages serve as transaction receipts

- 24/7 Notifications: Alerts work round the clock

Also Read :

How to Calculate Your Quarterly SMS Charges

Here’s a detailed breakdown of the charges including GST:

| SMS Alerts per Quarter | Category | Base Charge (Rs.) | GST @ 18% (Rs.) | Total Amount Payable (Rs.) |

| 3 SMS alerts | Up to 5 SMS | 0 | 0.0 | 0.0 |

| 8 SMS alerts | 6 to 20 SMS | 10 | 1.8 | 11.80 |

| 25 SMS alerts | Above 20 SMS | 15 | 2.7 | 17.70 |

BOI TRF SMS Charges (FAQs)

It’s the fee Bank of India charges for sending you an SMS alert each time you transfer funds (TRF = funds transfer).

Bank of India allows the first 5 SMS alerts per quarter at no cost.

The charge is Rs. 15 plus 18% GST, making it Rs. 17.70 per quarter.

Absolutely—use net banking, bank mobile apps, or passbook updates for free balance and transaction information.

Yes, Bank of India sends SMS notifications for every debit and credit transaction in your account.